How to Activate Concrete Borrow (Default Lite)

Concrete Borrow (Lite)

Concrete Borrow (Lite) is the foundational borrowing solution in the Concrete ecosystem, providing users with a streamlined experience and default protection against liquidation.

By default, Concrete Borrow comes with Concrete Lite, which forecloses loans early, reducing the risk of liquidation penalties:

- Early Foreclosure: If the Loan-to-Value (LTV) ratio approaches the liquidation threshold, Concrete Lite triggers an early foreclosure, avoiding traditional liquidation.

- Reduced Fees: This process incurs a 3.5% foreclosure fee, significantly lower than typical market liquidation penalties (5%-15%).

- No Activation Fee: Concrete Borrow (Lite) is active by default, with no upfront costs.

- Gas Fee Subsidy: Borrowers receive partial coverage for gas fees when taking out loans through Concrete.

Managing Concrete Borrow (Lite)

-

View Loan Overview:

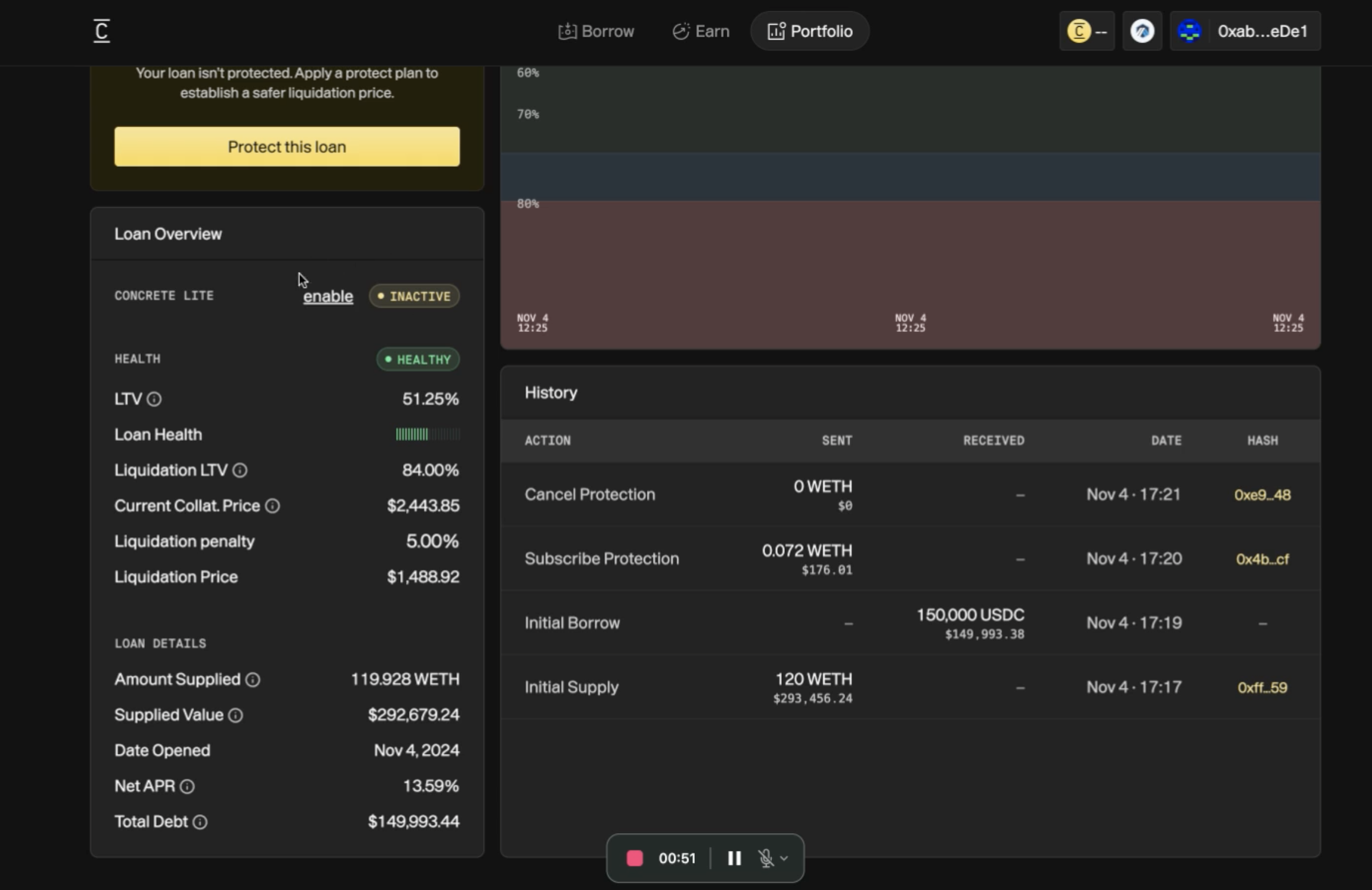

- The loan dashboard shows the current LTV, liquidation threshold, and the status of Concrete Lite.

-

Enable or Disable Protection:

- Users can choose to disable the default protection by toggling the disable button next to the Concrete Lite status.

- If disabled, users are fully exposed to the underlying market’s liquidation penalties.

Loan Overview Details

-

LTV (Loan-to-Value):

- Displays the percentage of the loan amount relative to the value of the collateral.

- In this case, the LTV is 51.23%, indicating the health of the position.

-

Loan Health:

- A visual bar showing the current health status of the loan.

- As marked "Healthy," it shows that the loan is far from the liquidation threshold.

-

Liquidation LTV & Price:

- Liquidation LTV: 80.80%, representing the point at which liquidation occurs.

- Liquidation Price: $1,547.89, the collateral value at which liquidation would be triggered.

-

Current Collateral Price:

- The market price of the collateralized asset, $2,443.85.

-

Concrete Lite Status:

- Active status indicates automatic foreclosure protection is enabled.

- Reduces liquidation penalties by performing a controlled foreclosure before full liquidation occurs, minimizing user losses.

Loan Details

-

Amount Supplied & Supplied Value:

- Indicates the user deposited 119.928 WETH, valued at $292,811.70.

-

Total Debt & Net APR:

- Displays the current outstanding loan value ($149,993.45) and the applied interest rate (13.59% Net APR).

-

History Section:

- A record of all loan-related actions, including:

- Initial Borrow: User borrowed $150,000 USDC.

- Subscribe Protection: Protection Status.

- Cancel Protection: Shows attempts to deactivate protection.

- A record of all loan-related actions, including: